Irs child tax credit update portal login information

Home » Trending » Irs child tax credit update portal login informationYour Irs child tax credit update portal login images are available. Irs child tax credit update portal login are a topic that is being searched for and liked by netizens now. You can Find and Download the Irs child tax credit update portal login files here. Get all royalty-free images.

If you’re looking for irs child tax credit update portal login pictures information related to the irs child tax credit update portal login topic, you have pay a visit to the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Irs Child Tax Credit Update Portal Login. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. That means that instead of receiving monthly payments of say 300 for your 4.

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Wnep Com From wnep.com

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Wnep Com From wnep.com

Jun 22 2021 Up to 10 cash back The IRS announced the availability of two new tools to assist qualifying families in managing their monthly Child Tax Credit payments which includes the Child Tax Credit Update Portal that allows families to opt out of receiving the advance payments. Today lets talk about this new tool and some other relevant updates. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Get more details by visiting the our blog. How Is the Child Tax Credit CalculatedFind Out Before the First Payment on July 15 Find. That means that instead of receiving monthly payments of say 300 for your 4.

Child tax credit 2021.

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. The IRS has launched their Child Tax Credit Update Portal to assist taxpayers in managing and monitoring advance monthly payments of the Child Tax Credit. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. Keep reading to learn more about the child tax credit portal update.

Source: elaguilanews.com

Source: elaguilanews.com

Two IRS portals are key to opting out updating banking infomation and more. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. That means that instead of receiving monthly payments of say 300 for your 4. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. The IRS has created specific online portals for updating your personal information and managing the payments that will begin to be distributed on July 15.

Source: aarp.org

Source: aarp.org

The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. That signifies that as an alternative of receiving month-to-month funds of say 300 to your 4-year-old you may wait till submitting a 2021 tax return in 2022 to obtain the 3600 lump sum. The two IRS portals are the best way for you. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments.

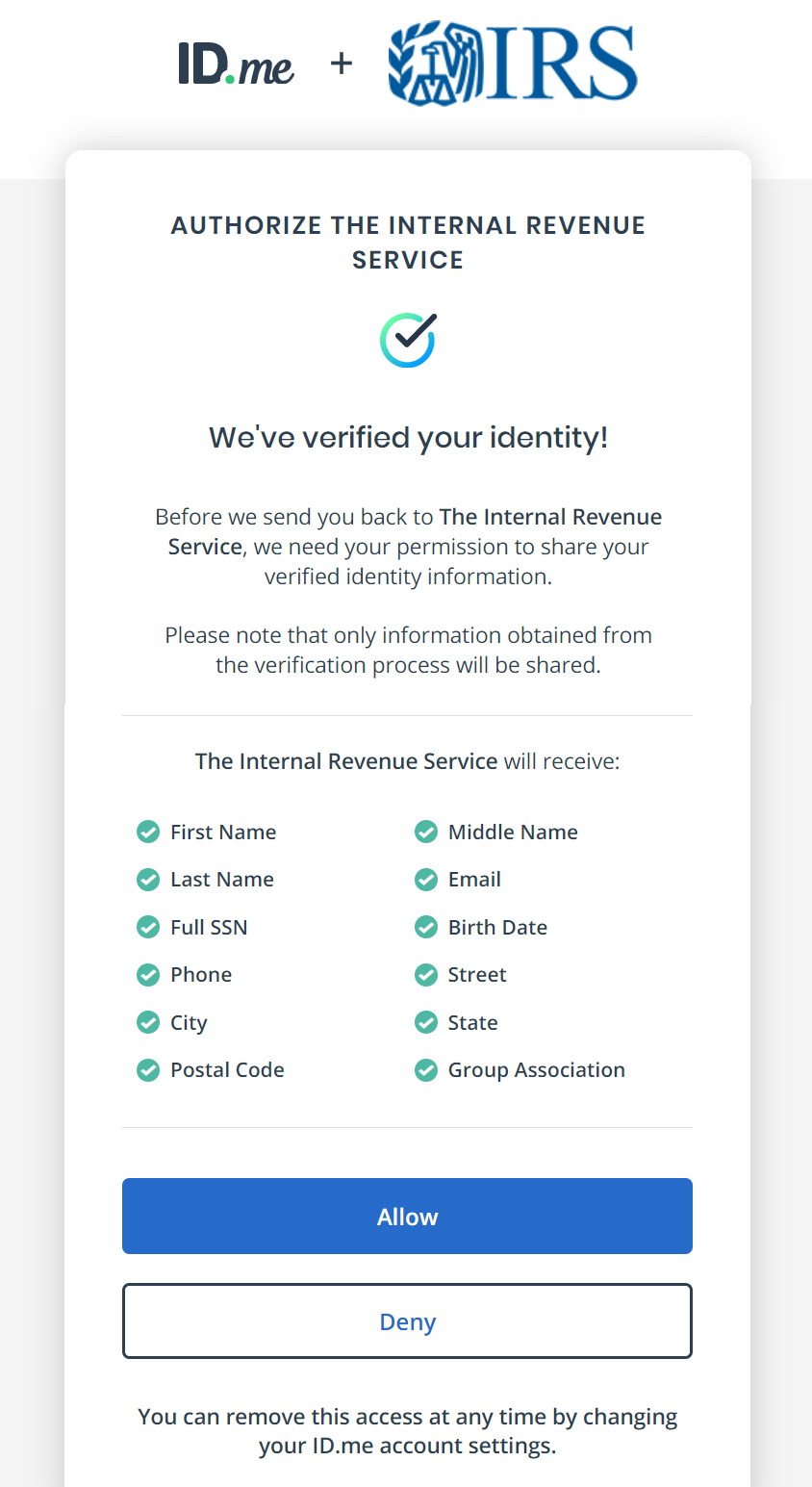

Source: help.id.me

Source: help.id.me

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. The tool also allows families to unenroll from the advance payments if they dont want to receive them. That total changes to. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. Half of the money will come as six monthly payments and half as a 2021 tax credit.

Source: nbc25news.com

Source: nbc25news.com

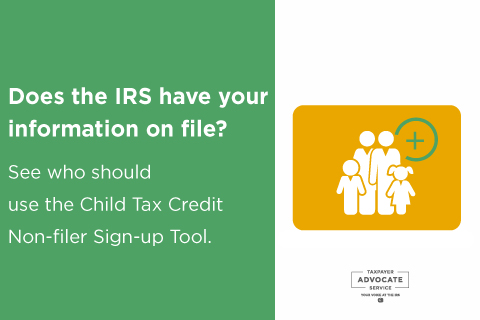

Because the IRS just released a new online tool to help low-income families register for the monthly child tax credit payments. What is the Non-Filer Sign. If you have an existing IRS account you do not need an IDme account to access the CTC UP. Child Tax Credit Payment Methods Heres How Youll Get Yours In order to sign in to any of the portals you will need to first verify. The IRS has created specific online portals for updating your personal information and managing the payments that will begin to be distributed on July 15.

Source: masslive.com

Source: masslive.com

Because the IRS just released a new online tool to help low-income families register for the monthly child tax credit payments. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. The Child Tax Credit Update Portal now permits you to opt out of receiving this 12 monthss month-to-month little one tax credit funds. Those with existing IRS accounts can still choose to sign in or create an account with IDme. Half of the money will come as six monthly payments and half as a 2021 tax credit.

Source: the-sun.com

Source: the-sun.com

The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. The tool also allows families to unenroll from the advance payments if they dont want to receive them. If you have an existing IRS account you do not need an IDme account to access the CTC UP. Simply select Sign in with an existing IRS username. Child Tax Credit Update Portal.

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. Simply select Sign in with an existing IRS username.

Source: forbes.com

Source: forbes.com

IRS Advance Child Tax Credit Update Portal CTC UP Login Options Existing IRS Users. IRS Advance Child Tax Credit Update Portal CTC UP Login Options Existing IRS Users. Those with existing IRS accounts can still choose to sign in or create an account with IDme. Half of the money will come as six monthly payments and half as a 2021 tax credit. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children.

Source: abc7ny.com

Source: abc7ny.com

The IRS has launched their Child Tax Credit Update Portal to assist taxpayers in managing and monitoring advance monthly payments of the Child Tax Credit. Child Tax Credit Payment Methods Heres How Youll Get Yours In order to sign in to any of the portals you will need to first verify. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. You will claim the other half when you file your 2021 income tax return. The IRS has created specific online portals for updating your personal information and managing the payments that will begin to be distributed on July 15.

Source: cnet.com

Source: cnet.com

Advance Child Tax Credit Payments in 2021. Because the IRS just released a new online tool to help low-income families register for the monthly child tax credit payments. Two IRS portals are key to opting out updating banking infomation and more. That means that instead of receiving monthly payments of say 300 for your 4-year-old you can wait until filing a 2021 tax return in 2022 to receive the 3600 lump sum. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: taxoutreach.org

Source: taxoutreach.org

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. Child tax credit 2021. The tool also allows families to unenroll from the advance payments if they dont want to receive them. The IRS will pay 3600 per child to parents of young children up to age five. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: wnep.com

Source: wnep.com

That means that instead of receiving monthly payments of say 300 for your 4-year-old you can wait until filing a 2021 tax return in 2022 to receive the 3600 lump sum. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. That means that instead of receiving monthly payments of say 300 for your 4. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. The IRS will pay 3600 per child to parents of young children up to age five.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

The IRS will pay 3600 per child to parents of young children up to age five. That means that instead of receiving monthly payments of say 300 for your 4. Child Tax Credit Payment Methods Heres How Youll Get Yours In order to sign in to any of the portals you will need to first verify. Taxpayers can use the portal to verify their eligibility for the payments unenroll or opt-out from receiving the monthly advance payments. Child Tax Credit Update Portal is a platform for Stimulus Payment check paid to American Families Child Tax Credit Update Portal will captured all your details and make payment to your bank account amount up to a maximum of 3600 for every child a family has under the age of 6.

Source: refundtalk.com

Source: refundtalk.com

That total changes to. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Child tax credit 2021. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. The IRS has launched their Child Tax Credit Update Portal to assist taxpayers in managing and monitoring advance monthly payments of the Child Tax Credit.

Source: cnet.com

Source: cnet.com

Because the IRS just released a new online tool to help low-income families register for the monthly child tax credit payments. That means that instead of receiving monthly payments of say 300 for your 4. The IRS has launched their Child Tax Credit Update Portal to assist taxpayers in managing and monitoring advance monthly payments of the Child Tax Credit. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The IRS will pay 3600 per child to parents of young children up to age five.

Source: abc7news.com

Source: abc7news.com

Two IRS portals are key to opting out updating banking infomation and more. Today lets talk about this new tool and some other relevant updates. The Child Tax Credit Update Portal now permits you to opt out of receiving this 12 monthss month-to-month little one tax credit funds. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. If you have an existing IRS account you do not need an IDme account to access the CTC UP.

Source: 5newsonline.com

Source: 5newsonline.com

You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. The tool also allows families to unenroll from the advance payments if they dont want to receive them. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Taxpayers can use the portal to verify their eligibility for the payments unenroll or opt-out from receiving the monthly advance payments. Jun 22 2021 Up to 10 cash back The IRS announced the availability of two new tools to assist qualifying families in managing their monthly Child Tax Credit payments which includes the Child Tax Credit Update Portal that allows families to opt out of receiving the advance payments.

Source: taxoutreach.org

Source: taxoutreach.org

The two IRS portals are the best way for you. That total changes to. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. Those with existing IRS accounts can still choose to sign in or create an account with IDme. How Is the Child Tax Credit CalculatedFind Out Before the First Payment on July 15 Find.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs child tax credit update portal login by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Ben platt everything i did to get to you information

- Cardi b please me information

- Acura integra ls sport information

- La liga assist leaders information

- Child tax credit portal add dependent information

- Don cheadle ray liotta information

- Acura integra hot wheels information

- Sofi stock bank charter information

- Irs child tax credit payment information

- Nanci griffith ukulele chords information